NA panel refuses to let estate builders bypass tax net

ISLAMABAD: Refusing to accommodate the property builders’ demand to stay outside the tax net giving them a free rope to purchase expensive plots and new cars beyond their declared worth, the government concedes that the restriction on transactions would cause disruptions, but such measures are necessary to tax the black money.

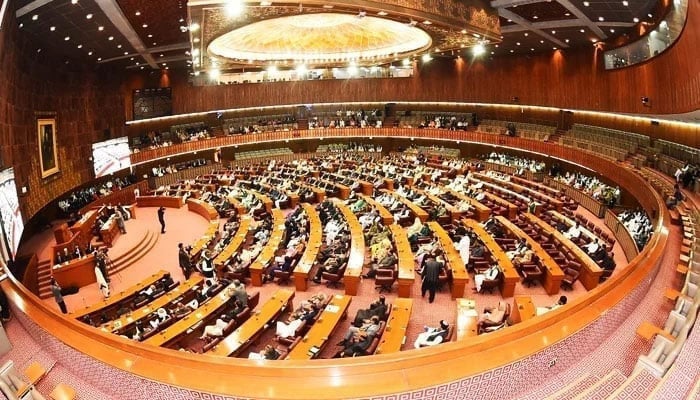

However, the National Assembly Standing Committee on Finance and Revenues has established a sub-committee to ascertain the limits of transactions for imposing any restrictions before granting assent to the Tax Laws Amendment Bill 2024.

The FBR high-ups informed the committee that out of a total of 0.3 million industrial connections, only 30,000 were registered with the Sales Tax regime and now they had proposed suspension of bank accounts of those preferring to stay outside the tax net despite paying out increased electricity bills.

On the income tax side, there are 6 million return filers and their immediate families, including wife, dependent children and old age parents, would be able to make transactions. So, practically there are 30 million legitimate persons who can buy plots of more than Rs10 million and new cars.

During the National Assembly Standing Committee on Finance, chaired by Syed Naveed Qamar, Minister of State for Finance Ali Pervaiz Malik Tuesday admitted that restrictions on the economic transactions of non-filers would cause some disruption, but it was necessary to document the black money.

Chairman Association of Builders and Developers of Pakistan (ABAD) Hassan Bakhshi argued that there were no restrictions on making transactions in the US, Canada and other developed countries but the FBR proposed such stern actions.

He requested the legislators to oppose such measures because if these measures were approved, then it would result in further halting of property transactions countrywide.

There are 30 trillion deposits in the banks out of which 60 percent of the money is owned by the non-filers. The ABAD chairman asked for a gradual approach but most of the committee members did not seem convinced.

However, the committee chairman clearly said they could not oppose the FBR on the proposal to take action against the black money.

After a lengthy debate, a sub-committee was constituted with the mandate to ascertain the limit of restrictions for those declared unfit to make major transactions.

The FBR high-ups also informed the committee that they had developed an application to update or amend the declaration into filed returns increasing the worth of filers and then they would declare legitimate for allowing them to make transactions in property or purchasing cars.

Earlier, the state minister said the non-registration of non-filers for the last many years was a failure of the state and governments adding that using non-filers for revenue generation was disastrous for the documented economy.

He added that the government preferred to remain silent on non-filers for 75 years and was now addressing the issue.

The persons having undocumented wealth, he argued, wanted avenues to park their illegal money.

“If the government is able to stop the use of around Rs9 trillion cash in circulation, the non-filers would be forced to come into the tax net. Only 5 to 6 million filers cannot run the country, and we have to go after under-taxed and non-taxed sectors,” he said.

Quoting an example, he said there was a time when people used to deposit 2 million Dirhams in the banks of Dubai and no questions were asked but now, they generate suspicious transaction reports (STRs) and currency transaction reports (CTRs) and report them to Pakistan,” he said.

“Either the money is white or black, or there is no grey money”, the minister maintained.

The committee members from the PPP, PTI and PMLN asked the FBR chairman to explain the impact of these restrictions on the non-filers and the overall economy. Hina Rabbani Khar MNA from the PPP termed such measures draconian and called for curtailing such sweeping powers of the tax machinery.

Chairman FBR Rashid Mahmood Langrial and Member Hamid Ateeq Sarwar informed the committee that the people having undeclared income were facilitated and documented sectors were overburdened with taxes.

He said the revenue collected in 2008 and 2016 was the same as collected in 2024 meaning that they had not moved a bit from 2008 to 2024.